we are back!

everything mentioned in the last updates playing out well.

in terms of big-picture perspective, this is NOT the end of the cycle.

if we do get a big flush then it would be a good time to add to high-conviction plays. BTC ETH SOL COIN GLXY MARA CLSK.

55-58K for BTC. 2600-2800 for ETH and 100-115 levels for SOL are deep value zones for accumulation.

memes as a category are here to stay. when the uptrend resumes you will see them making a comeback.

SOL has been and continues to be the strongest play among majors.

BILLY has gone on a tear and continues to look one of the best plays along with POPCAT.

both are candidates to repeat the wif like move from last year.

we now also have a HTF breakout and confirmation.

trend model is long BTC ETH SOL.

among majors SOL continues to be the best bet.

MEMES

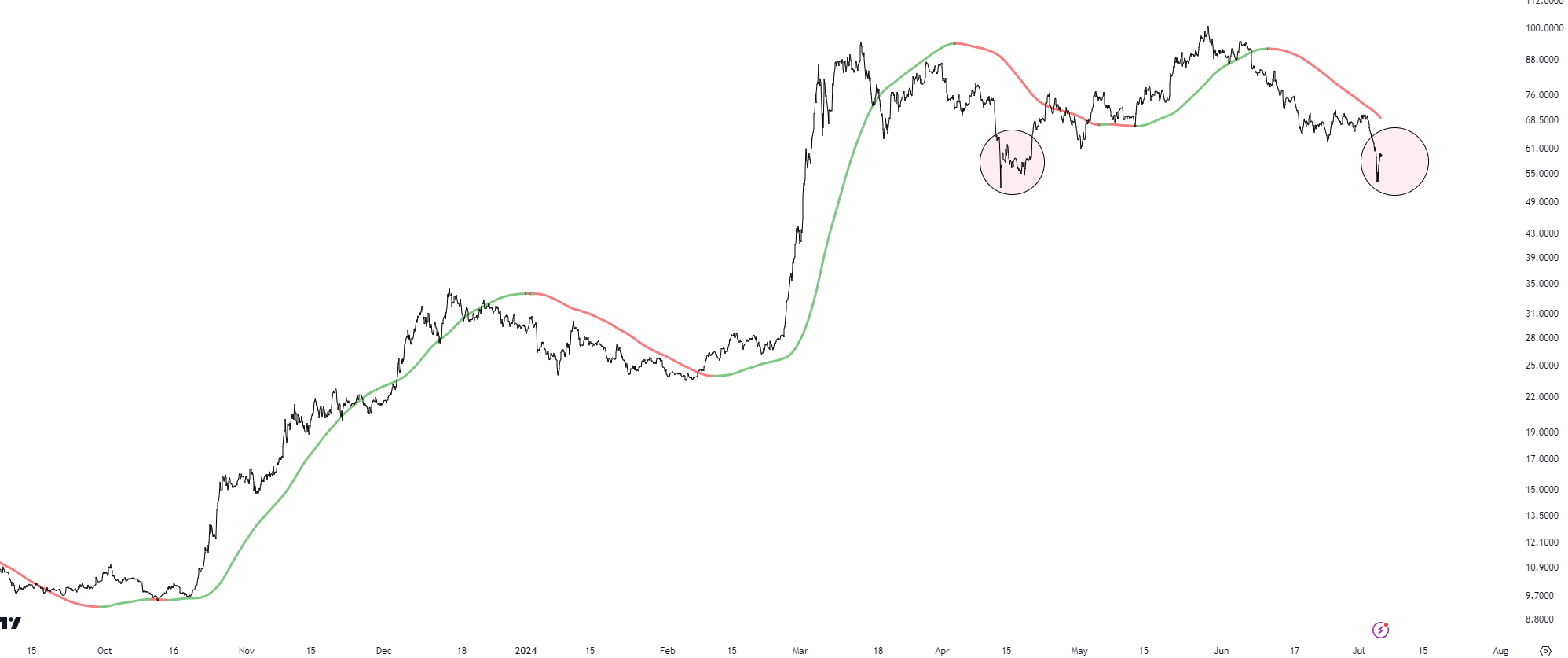

lets do the majors meme index first.

in the last update i had mentioned

in terms of where we are.

it looks eerily similar (marked in circle) to the last meme capitulation event in april.

from here on likely path is bit consolidation before resuming the path higher.

its played out precisely that way.

from here on we are looking at a parabolic move.

BILLY POPCAT BONK

continue to be the highest conviction plays.

rationale remains the same. also trend momentum aligns with this thinking.

there are few more memes showing strength.

just waiting for the trend confirmation and want to ensure momentum is durable in them.

till then these 3 are the ones.

ALTS.

this continues to be a meme cycle. non-meme alts are hardly catching a bid.

every breakout and strength are dominated by memes only.

among such there are only 2 alts showing strength for now.

MOBILE and RAY. model continues to be long these 2.

exited the rest as the momentum fizzled out.

NOTE: use the w3q indicator.

i have clarified in one of indicator faqs what to expect.

see you in the next one.