update

ADMIN STUFF

- the plan for transitioning from the newsletter to the community format is still on.

- before transitioning I wanted to refine and thoroughly test the LTF systems. this will allow us to make more short-term trades.

- also working on an execution strategy for LTF. will make an announcement when the testing is complete.

- now that Solana and Bases dexes are integrated on tradingview I have been upgrading the scanners too, which will allow us to be

100% quantitative on entries/exits on all picks. even memes.

coming to HTF trend system update the model is sitting on CASH.

this shouldn't be surprising as mentioned in the last update before the correction "momentum waning"

momentum is significantly degraded across the riskON assets.

DXY also is threatening another breakout to the upside.

if this continues trend models will likely signal exits soon.

despite all the good news around tradfi flows into ETFS or favorable regulatory stance or big crypto acquisitions etc

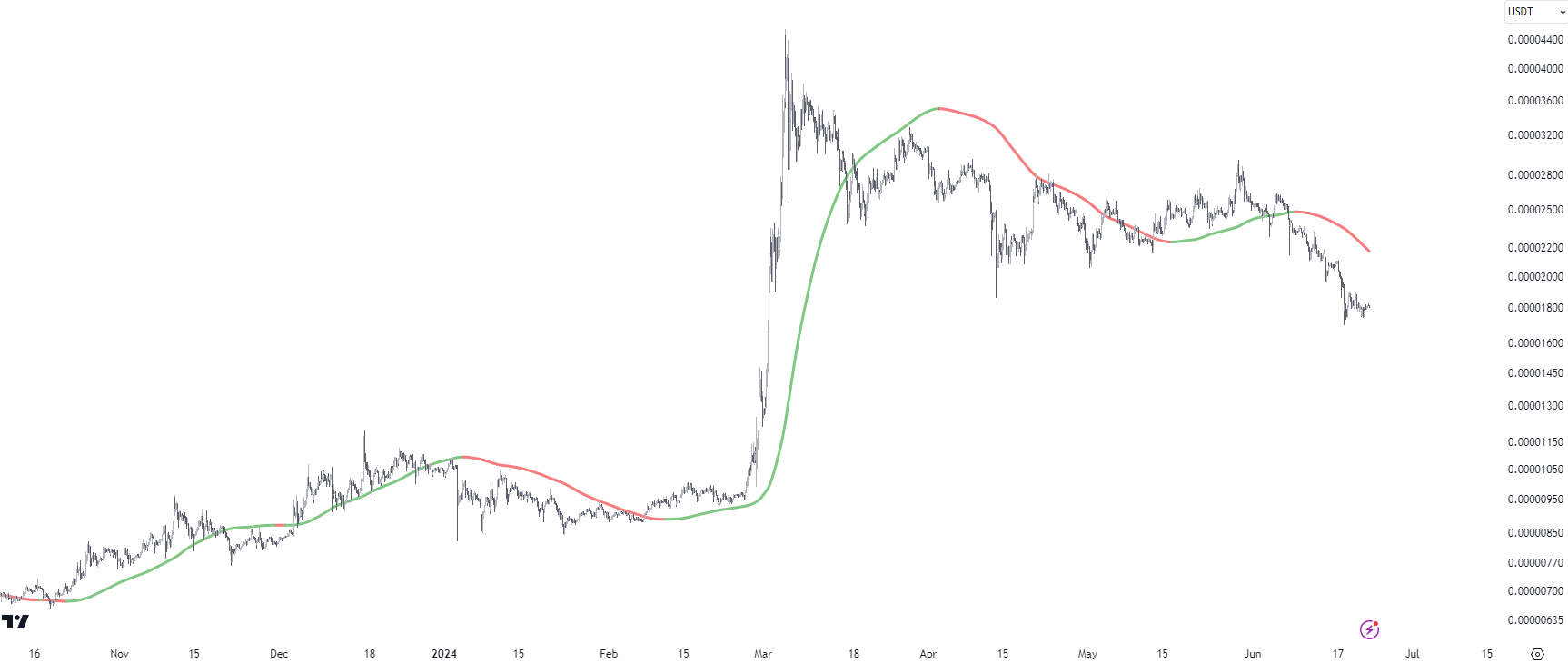

the meme majors (one of the highest betas) have been lagging.

when good news doesn't lift the price and bad news doesn't push the price down, it's important to pay attention and adapt accordingly.

while you will always have the odd plays doing well data clearly shows the trend is getting bearish for now.

heres how the web3quant indicator is doing.

heres how it's done on the web3quant custom meme index and most liquid memes.

NOTE: i have clarified in one of indicator faqs what to expect.

so where do we go from here.

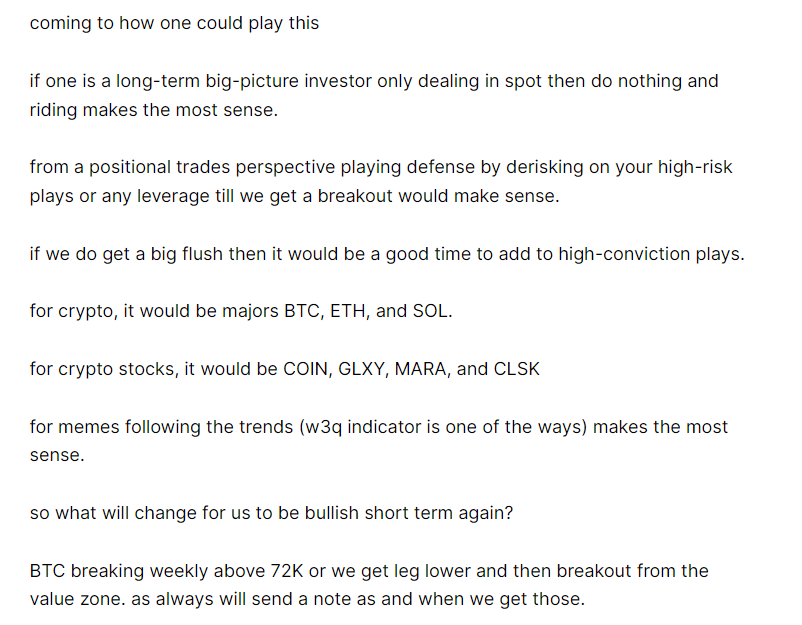

HTF trend wise we will only go long when we get the next signal.

on LTF we are at oversold levels and the sentiment has turned extremely bearish we could be seeing some relief rally.

i have been tweeting the same during the last LTF relief rally too,

to use it to offload all the duds and focus only on high-conviction plays.

when the next uptrend resumes. not all coins will go back to the highs.

new uptrend, new plays are typically the norm.

in terms of big-picture perspective, this is NOT the end of the cycle imo.

also as mentioned in the last update.

55-58K for BTC. 2600-2800 for ETH and 100-115 levels for SOL are deep value zones for accumulation.

in terms of alts and memes, will be following the HTF trends and will send the list when the model picks them up.

you can use the w3q indicator for the ones you have conviction on.

memes as a category are here to stay. when the uptrend resumes you will see them making a comeback.

in summary, the overall markets are still weak but this correction is a great opportunity.

see you in the next one.