TradFi Update: Macro Looking Ominous?

Models' call to exit a lot of names last week is proving to be a good call thus far.

As mentioned in the last update

The model has made a lot of exits. SPX. NDX. Tech Majors.

It important to remember, these are high-time frame trades. Model has been long many of the names since Jan 2023. Many of them are up a lot.

Model will re-enter the positions again on resumption of the uptrend.

SPY, NDX and some of the big names like Apple, MSFT Tesla have had a negative week and are looking vulnerable for further downside.

The model has exited the remaining stocks and tech names too.

Macro continues to look bleak.

Models continue to be bearish on the bonds.

Among the macro variables, interest rates and bonds seem to be the most vulnerable spot. TLT continues to be weak.

To add to that, USD (DXY) threatening to break out. Models already signaling bullish on lower time frames. Unless there's a big reversal soon, we could get a high time frame confirmation there too.

This would confirm a major risk-off signal and we could be looking at a strong correction in the markets.

As they say there's always a bull market somewhere.

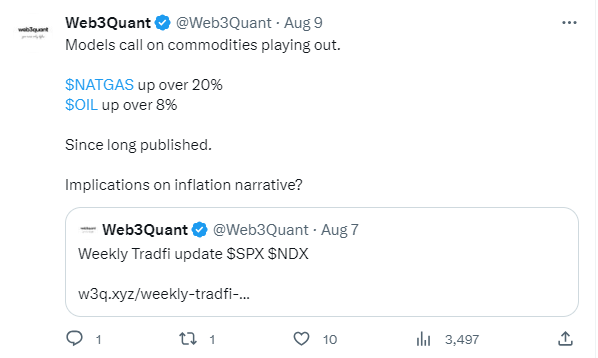

The model continues to be long commodities (Oil, Natural Gas and their respective ETFs). The call is playing out well thus far.

If this continues then it would have major implications on inflation and the FED policy narrative.

W3Q has published a How-To guide for those interested in learning how to best use the model insights. Check it out.

Coming to the model positions. There have been multiple exits and no new entries.

** Web3Quant is not registered with any financial regulatory agencies. Web3Quant is purely a research publishing firm that provides no personalized financial advice. Do your own research and consult your financial advisor.**