NFT Model Insights

For a while, I have been working on developing a Quant Model for NFTs.

Challenge was unlike Alts which have a lot more data for backtesting,

NFTs are just a wild wild west with very different dynamics and highly inefficient markets.

Now the upside to such a situation is there's a lot more alpha on the table till the market matures.

Before we get into it, here are some things to note

- Do not go crazy with sizing. The volatility in NFTs makes Meme coins look like Treasury Bonds.

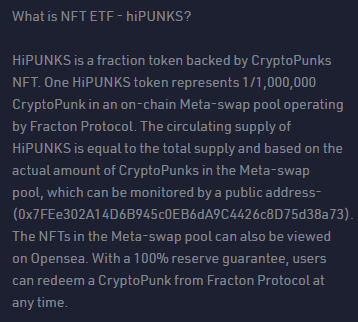

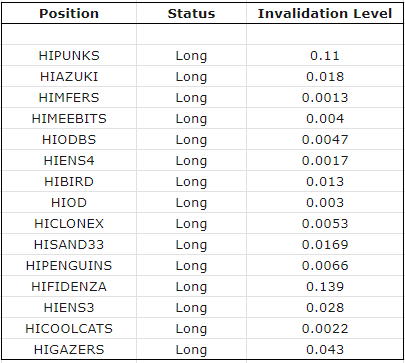

- For now only NFT-ETFs listed on Kucoin would be published as they trade like any other Alts (USDT pair), and we only are dealing with the Price and not aesthetics or anything else (check the image below).

- NFT-ETFs are chosen for simplicity but I will be engaging with you all to understand if the correlation is working well on the actual NFT collections.

- In the future, Solana NFTs would be added too.

- All of these insights are quant-based and on similar principles as the other Web3Quant models. Although the way in which the trend, momentum, and other parameters are captured, differs.

- Remember these are trades, there will be entries, exits, and re-entries. If you are HODLer with attachments to pictures and only looking at these insights to confirm your bias to HODL then this is NOT for you.

- They are traded on a Lower time frame compared to the weekly time-frame Crypto Model, which means there will be many updates coming on NFT-ETF trades.

- As a premium subscriber, you will receive the NFT insights and updates first but they are NOT part of the premium subscription.

As mentioned before they would be launched separately as an offering in the coming weeks.

** Web3Quant is not registered with any financial regulatory agencies. Web3Quant is purely a research publishing firm and does not provide any personalized financial advice. Do your own research and consult your financial advisor.**