Newsletter #10 Bottom in for Bitcoin, Ethereum & Crypto?

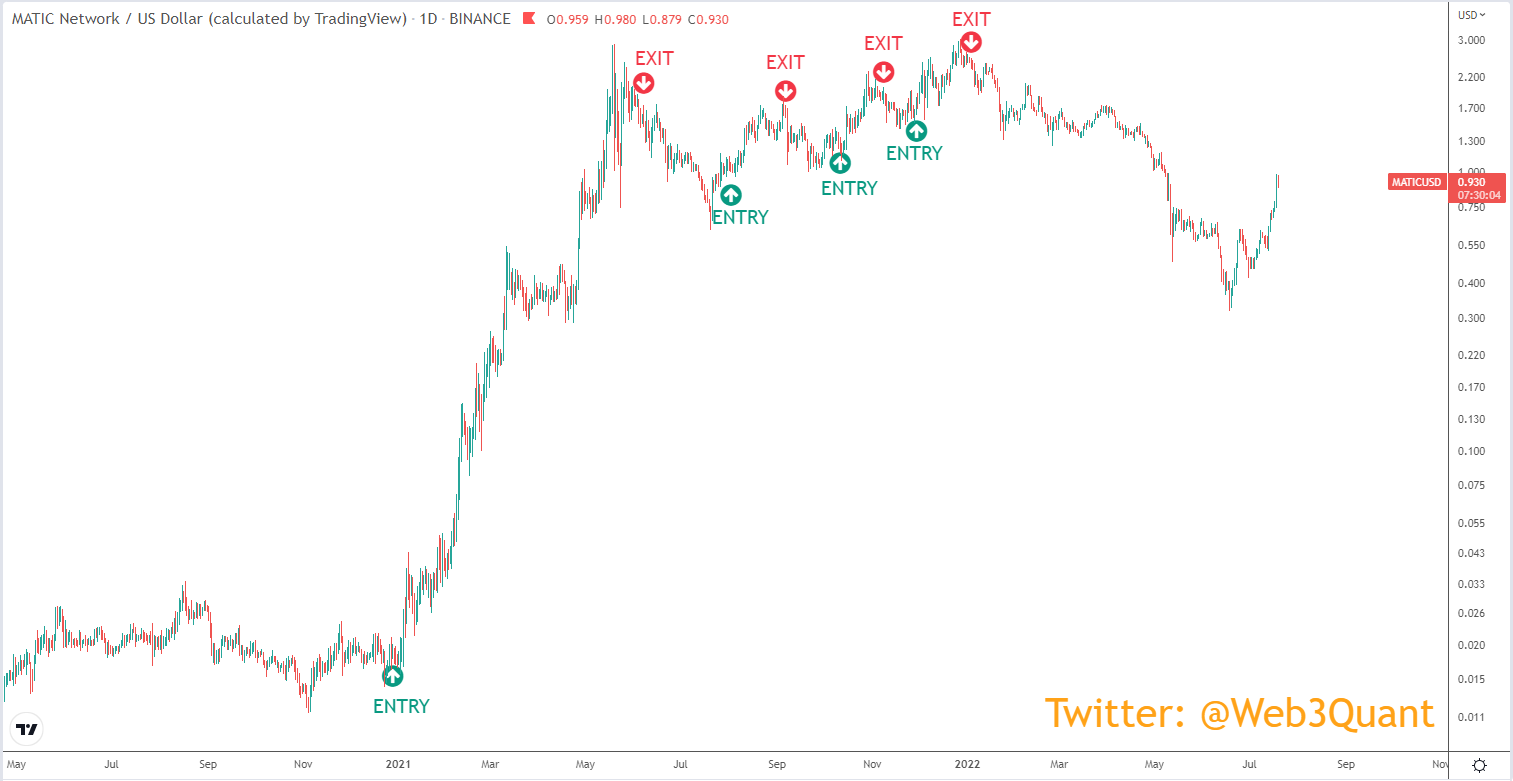

Let's start with a shameless plug. My Quant model has successfully caught the Macro Top in Crypto by exiting in Nov 2021 and has stayed in cash throughout this carnage. Captured 100x moves in Sol & Matic. Exited Eth @$4100 levels. Exited Luna @$85 levels before its demise. Called Cardanos top in Sep 2021 @$2.6. Captured multiple 20x moves in a lot of alts such as doge, and metaverse coins in the last crypto bull cycle. Check out the Performance page for more details.

Also on the About page, I have laid out what to and what NOT to expect from the model along with some FAQs.

Now all of the above results are before I went public with the model. and you should NOT believe in what an anon says on the internet. Always pays to be skeptical.

Since I went live in May, I have been sending out a weekly newsletter where I have clearly been stating that the model has been sitting on CASH. Anyone listening to that too would have avoided a 50% draw-down in $BTC, $ETH, and much more in Alts.

I will continue to publish the output of the model every week outlining ALL the calls that the model makes and not just selective out-performance. Unlike most Crypto OGs and influencers, I won't get into ambiguous "if this then that" analysis or hedge my posts with both bull and bear scenarios which doesn't help anyone. The model is either LONG or sits in CASH. It has been designed to tolerate volatility and capture big moves and not scalp a percent here and there.

After the capitulation weekend at the end of June when Bitcoin touched 17K, in the weekly update, I wrote this

There are lots of telltale signs that the bottom in Bitcoin could be really close if not already in.

Greed and Fear Index had a reading of 6, the lowest it has ever been.

Lots of unwinding and liquidation of big funds such as 3ac and others.

Most crypto OGs capitulating and giving insanely low targets.

CT has practically been a ghost town.

Mainstream media folks like Roubini Crammer, etc writing Crypto obituaries. These things typically happen at the tail end of the correction.

Majority of the traders are better off counter-trading their own sentiment.

I am just waiting for the Model to confirm the bottom signal. Will send out the note as soon as it does.

Since then in every week's update, I have been mentioning that I am just waiting for the model confirmation to call the bottom which happened last week.

Now before you degens pile on leveraged longs, I would like to set some expectations. Bottom signal doesn't guarantee a V shape rally. In fact, most bottom formations are U-shaped which means time corrections follow a price correction. Both COVID crash recovery and those of you old enough to have been trading in 2009 will remember the 2009 GFC crash V-shape recovery in equity was an exception.

Model backtest has managed to call the previous macro bottoms in Bitcoin in Dec 2018 and Jan 2015 too. In the case of 2015, even though the price bottom happened in Jan 2015, the BTC went sideways till Aug 2015 before starting the explosive up-move. The model has been thoroughly back-tested but we need to remember that the sample size of the data in crypto is too short (just over a decade) to make really make unhinged predictions.

Currently, the model has flashed a bottom signal in Bitcoin @$19K, Ethereum@$1050, and Total Crypto Marketcap @$850B. Will the model be right again? We will only know that in hindsight. What about your favorite alts and crypto stonks you ask? Most of them are up quite handsomely from the lows but the model hasn't gone long on any of them yet. I will update when it does.

Below are the updated chart of top cryptos with Models signals from 2020 to date.

** Web3Quant is not registered with any financial regulatory agencies. Web3Quant is purely a research publishing firm and does not provide any personalized financial advice. Do your own research and consult your financial advisor.**