Newsletter #30 Going to be a big week!

Same as last week, the model continues to sit on 100% cash.

Let's do the macro first and then we can get to some of the tactical crypto trades.

As mentioned in previous updates, the Model turned bearish on US Dollar 3 Weeks ago. That call has done really well. DXY has been down -5% since. In the Forex world, a 5% move is considered pretty wild and has big implications across the board.

Old-time readers of the newsletter would know the model has been able to successfully capture both the crazy upside and now downside move in the DXY perfectly.

Considering the magnitude of the move that's happened already, there could be some relief bounce to 109 levels from the current level of 106 but the price structure seem to have broken for now.

Model continues to be bearish on DXY.

The interest rates seem to have plateaued too.

The model is also bearish on US10Y.

The invalidation would be persistent closing above 4.5%

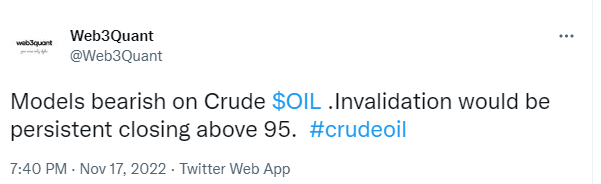

Earlier in the week, I tweeted about the model being bearish on Crude OIL. That trade is doing well thus far and the position is up by 6%.

The model continues to be bearish on Oil.

Coming to stocks, when the model had turned bearish on DXY weeks ago, it had also turned bullish on both Crypto and Stocks as mentioned in the update.

While after the initial up-move the crypto got hammered by the FTX debacle, the stocks have had a nice rally. Both SPX & NDX are up over 7% since.

Model continues to be bullish but there is some waning of the momentum on the lower timeframes. So there could be a pullback which also aligns with a bounce in DXY.

If one is interested in longs in stocks then Dow Jones is the strongest among the 3 US stock indices.

Coming to crypto, the model's call to get into cash last week has been playing out all right thus far. It's been rough and crypto has been taking it on the chin. Skeletons keep coming out of the closets and the contagion news doesn't seem to stop. The latest is the rumors about the solvency of one of DCG's subsidiary companies. After FTX, it's really hard for anyone to be confident about any company. if it turns out they are in trouble then crypto would react very badly to it, on the other hand, if they manage to remain solvent and put the fears to rest then it could rally sharply. It's a hard one to assess unless you are a DCG insider, to be honest.

So what can we do?

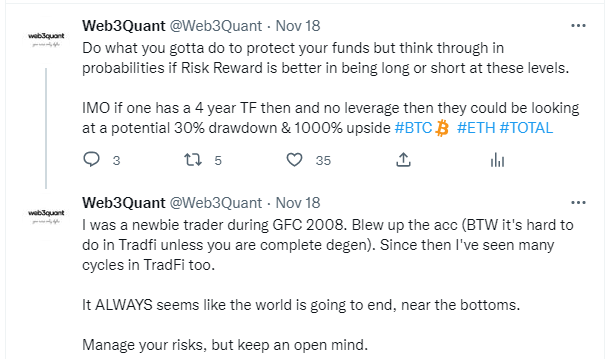

Firstly, try to get a lid on your emotions. I know, not easy considering what's happening but it's important if you want to be around long-term in the investing game.

Also remember, even the biggest influencers/ traders who come across as cool and super profitable also have had a big impact on their PnL, and it's not just you. They just cannot afford to appear weak as their business model depends on it. So don't let that get to you.

Lastly, We are in a game of probabilities and NOT possibilities. So try and think in terms of that as I mentioned in the tweet below.

From a long-term investing perspective I am sticking to the plan I have been writing about for weeks.

Bitcoin and Ethereum are entering the value zone, if we do get a market-wide sell off then it would be a great time and price to accumulate these assets for those who believe in this space. The above logic applies to ALL cryptos/stocks that you believe will survive the next 5 years.

So I will buy either on a complete NUKE aka BTC in the range of 14k-17k if we get one or on a Long signal by the model. I would be using this opportunity to DCA into long-term holdings. $BTC & $ETH feature in them but I have also laid out a long-term investment thesis on crypto stocks. You can check them out here - HUT8 and Galaxy Digital. I also like Riot Blockchain (similar thesis to HUT8) and Coinbase.

From a trading perspective, AltUSD price structures have been damaged so until we get the breakout there are some trading opportunities in the AltBTC pairs.

I shared a few ideas on Twitter earlier in the week.

Model was bullish on $CHZBTC, it had a nice 20% spike after the tweet but it couldn't sustain and the trend seems to have broken for now. Model exited the position and Will re-enter if there's another breakout.

Model is bearish on $ETHBTC.

Model is bullish on $LTCBTC

Model is bullish on $XMRBTC

Below are the Models signals on BTC, ETH, and Solana from 2020 to date. I have been publishing this every week since I went public in May and will continue to do so.

** Web3Quant is not registered with any financial regulatory agencies. Web3Quant is purely a research publishing firm and does not provide any personalized financial advice. Do your own research and consult your financial advisor.**