market update & indicator enhancement

theres a lot to unpack in this update so lets split it into 2 sections. indicator enhancement and market updates.

INDICATOR UPGRADE

- its already live.

- just logout and relogin to tradingview. delete and re-add the web3quant indicator and it will work.

thank you to those who have given suggestions on making these improvements.

as always if you have any practical ideas on how it can be made better or more useful to you let me know, will try and incorporate it in the future releases.

just to set expectations. only what's feasible will be looked into not all wishlists.

potency of the indicator is in its simplicity and decision making using a singular timeframe.

what are the differences?

- core remains the same.

green for buy. red for sell. black for potential reversals. lines also act as support resistance levels. - the biggest update is multi timeframe support which was not working well in the earlier versions.

- signals are more responsive while the noise has reduced further.

- improved support/resistance levels.

let me explain with results.

Change 1 and why?

- everything is optimized for 4H timeframe.

previous version was optimized for 3H timeframe.

while there was nothing wrong with 3H it was throwing off a lot of traders couple of reasons.

i) 4H is one of the standard timeframes used very commonly.

so a lot of traders are intuitively accustomed to the 4h price action both in tradfi and crypto.

theres also a lot of technical books and study material on 4h.

ii) they use W3Q indicator along with their own systems many of which work on 4h tf so they would run the previous w3q version on 4h by default and would get suboptimal results.

Change 2 and why?

- multi timeframe - now the signal timeframe and the time frame you want to run the chart on can be separated.

even though the earlier version too had this option it wasn't working 100% of the time.

- now you can set the timeframe to 4h and run the chart on anytime timeframe.

this helps with 2 things.

i) just like some people like 4h, some like 5m and some like daily price action.

now everyone is free to operate on the tf of their liking while getting the best from the indicator.

ii) setting it on 4h and running lower timeframe can sometimes lead to more responsive signals.

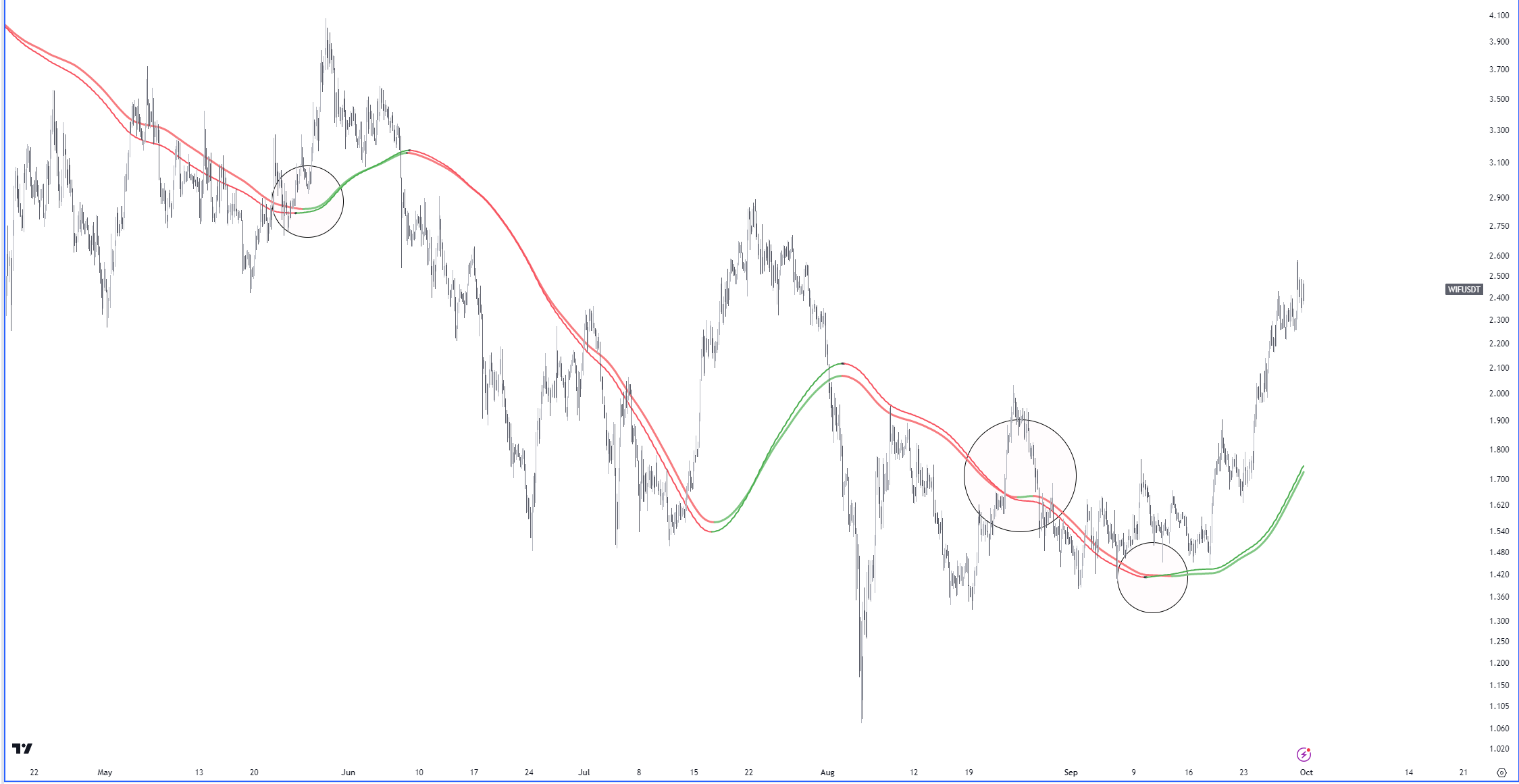

this is particularly helpful in memes and altcoins where the moves are more violent and waiting for 4H or a daily close could mean losing out on a lot of meat in the move.

Change 3 and why?

goal always is to have max responsiveness (how quick you get the signal) with minimal noise (fake signals).

there are 2 kinds of people.

one who believe indicators and technicals is astrology for men and dont work. others who believe its a money printer and can do everything.

indicator is just a tool and results will depend on how best one can use it. now there are good tools and bad tools.

great indicator is the one which can give you consistent results on a singular timeframe (in w3q case 4h) universally on all assets.

even moving averages do a decent job for that matter. just that you would need different MA on different tf for different assets for it to work.

this defeats the purpose and makes decision making extremely difficult by analysis paralysis.

if you have too many signals, then its as good as having no signal.

lets do some examples.

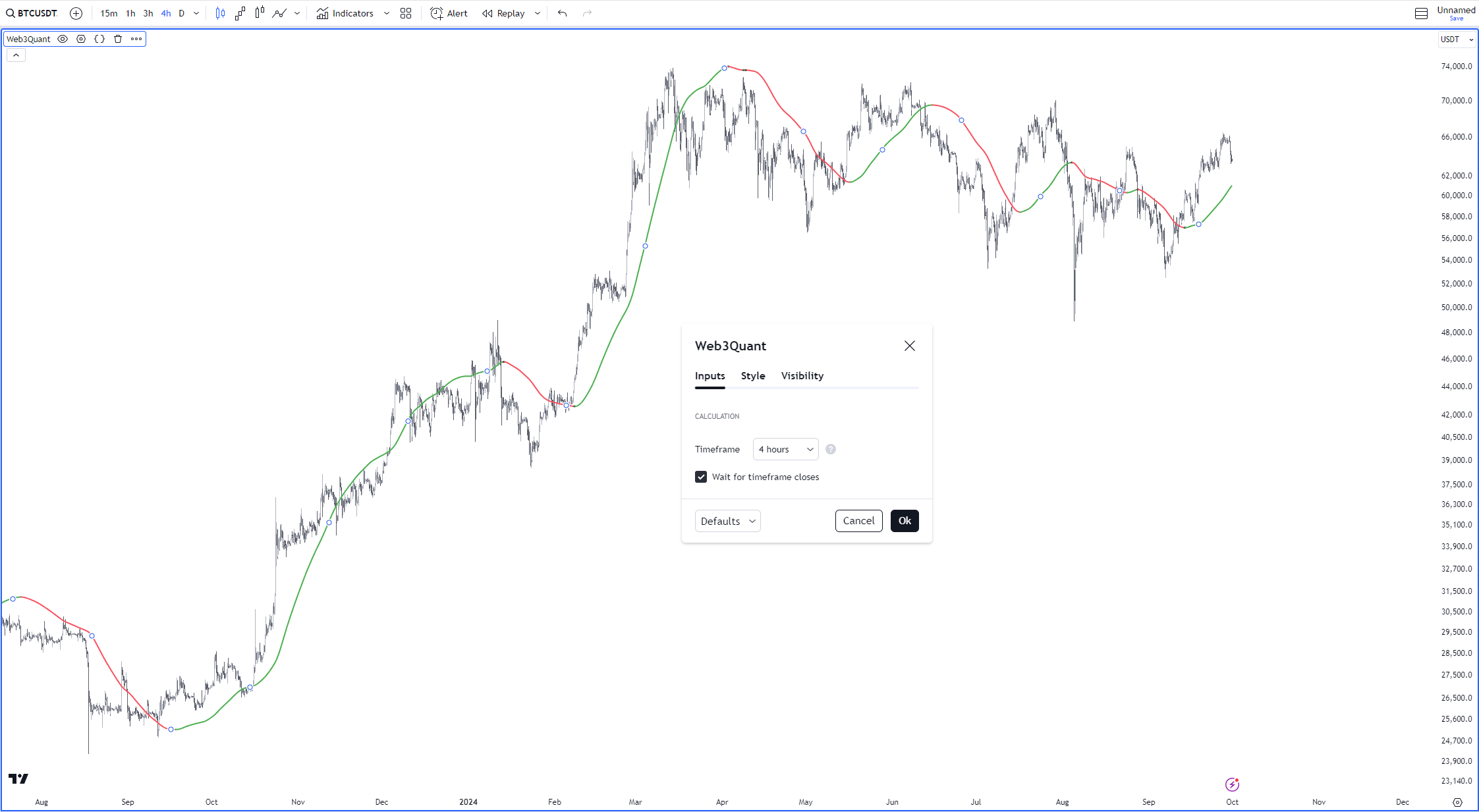

tf is set to 4h. and I have run it on BTC 3h,4h,daily. results in same signals.

I have only covered few examples. you can backtest it on other timeframes and settings that suits your style.

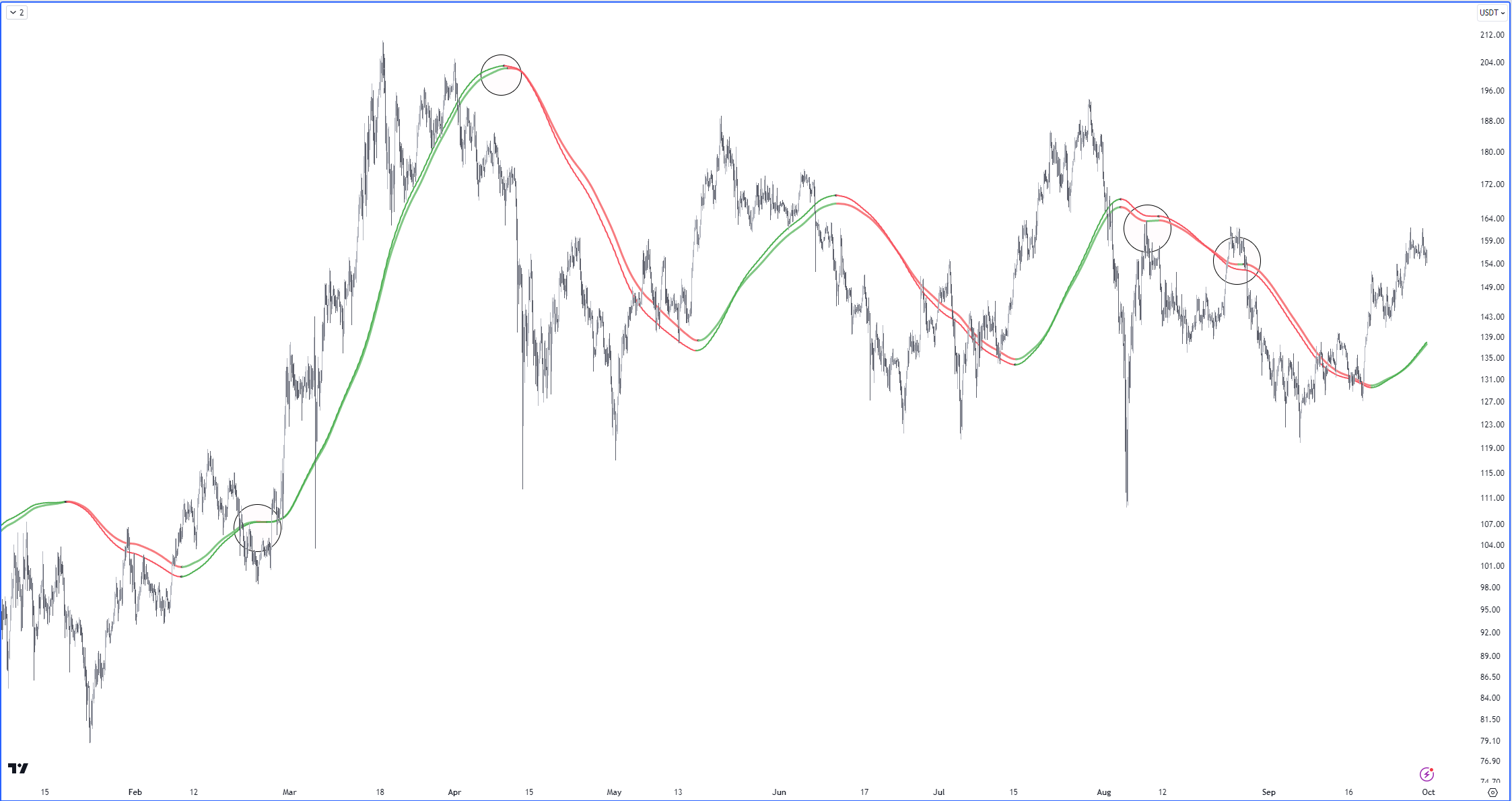

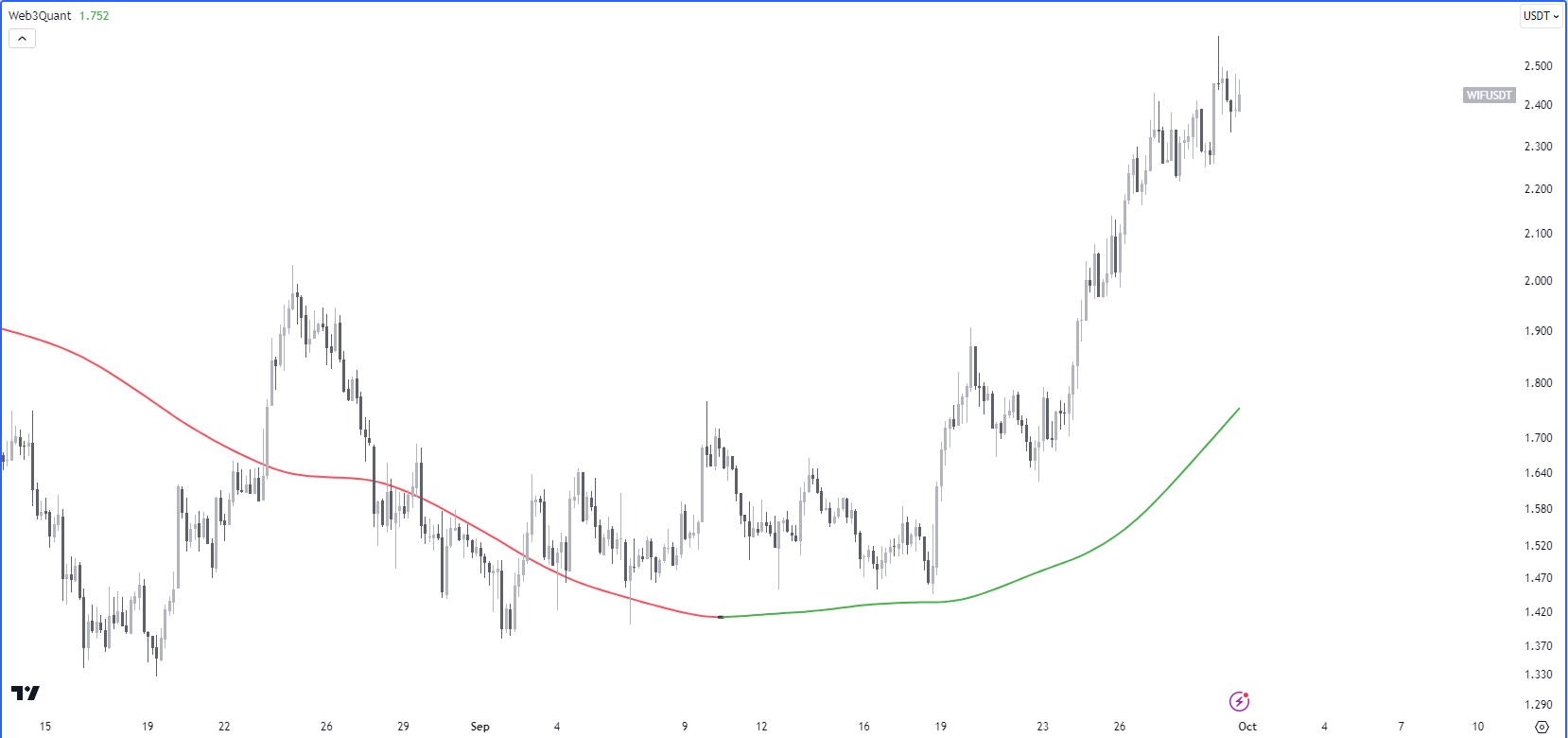

below is the example of solana and wif.

i have overlayed the output of old version vs new on latest price action.

a lot of fakeouts are cleaned up while improving responsiveness in some cases (marked in circle)

NOTE: on these tf even 1 or 2 bar improvement would lead to a lot of gains.

MARKET UPDATE

model remains long btc eth sol.

no change in base case from what was mentioned previously

we have now gotten the breakout. the move has been sharp so some pullback to retest 58-60K wouldn't be surprising in the next couple of weeks.

if we get it then it would be the ideal time to get into strong alts.

there are a few potentials will be sending it in a table format then.

here are some of the strong ones

MEMES

outlook is similar when it comes to memes.

they continue to be look like the most dominant sector of this cycle.

see you in the next one.