market update

models long BTC and SOL.

continuing from previous updates broader view remains the same.

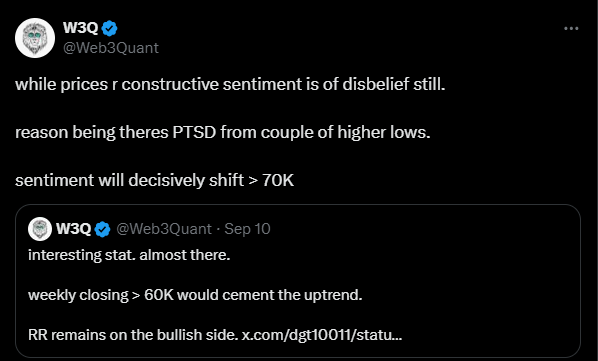

good news is the sentiment is still mixed and theres very little euphoria on this breakout.

this is primarily due last couple of breakouts failing and causing a higher lows.

while theres never guarantees this breakout is THE one

all data thus far is favorable.

this week we have a big policy outcome from the fed which is causing some derisking ahead of the event but its nothing scary

now like always media will hype it up making it seem like 25bps or 50bps rate cut will have dramatically different outcome.

its never does. if markets were to tank it would regardless of 25 or 50 and vice-versa.

fed has been guiding well ahead of their plans so the big smart money is already positioned for it.

markets only get spooked if theres unexpected policy (like what happened a few weeks ago from Bank of japan)

everything else gets priced in well in the macro land.

sure there will be some expectation and on the day we will have some volatility regardless but the base case remains risk assets are headed higher.

NOTE: a lot of folks ask me are things as simple as I write in these updates. my updates are written in eli5 format by design.

my work involves complexities but I try to abstract all that as best as I can and keep it simple.

global liquidity is trending higher.

GOLD ATH

US Stock markets are on the verge of ATH

USD making lows

are all suggesting we are meaningfully headed higher.

crypto never takes linear path like the above mature assets. so the moves come in bursts and the catch up is swift in both directions.

this is how the web3quant indicator has performed on all assets on a standard 3h timeframe.

MEMES

NOTE: after every single update I get questions around what about this meme or that meme. every meme wont be covered in every update.

just because its not covered doesn't mean anything either ways.

as I have repeatedly mentioned they are highly volatile and majority are destined to goto 0.

its always a good idea to trade cults but NOT act like you are in one.

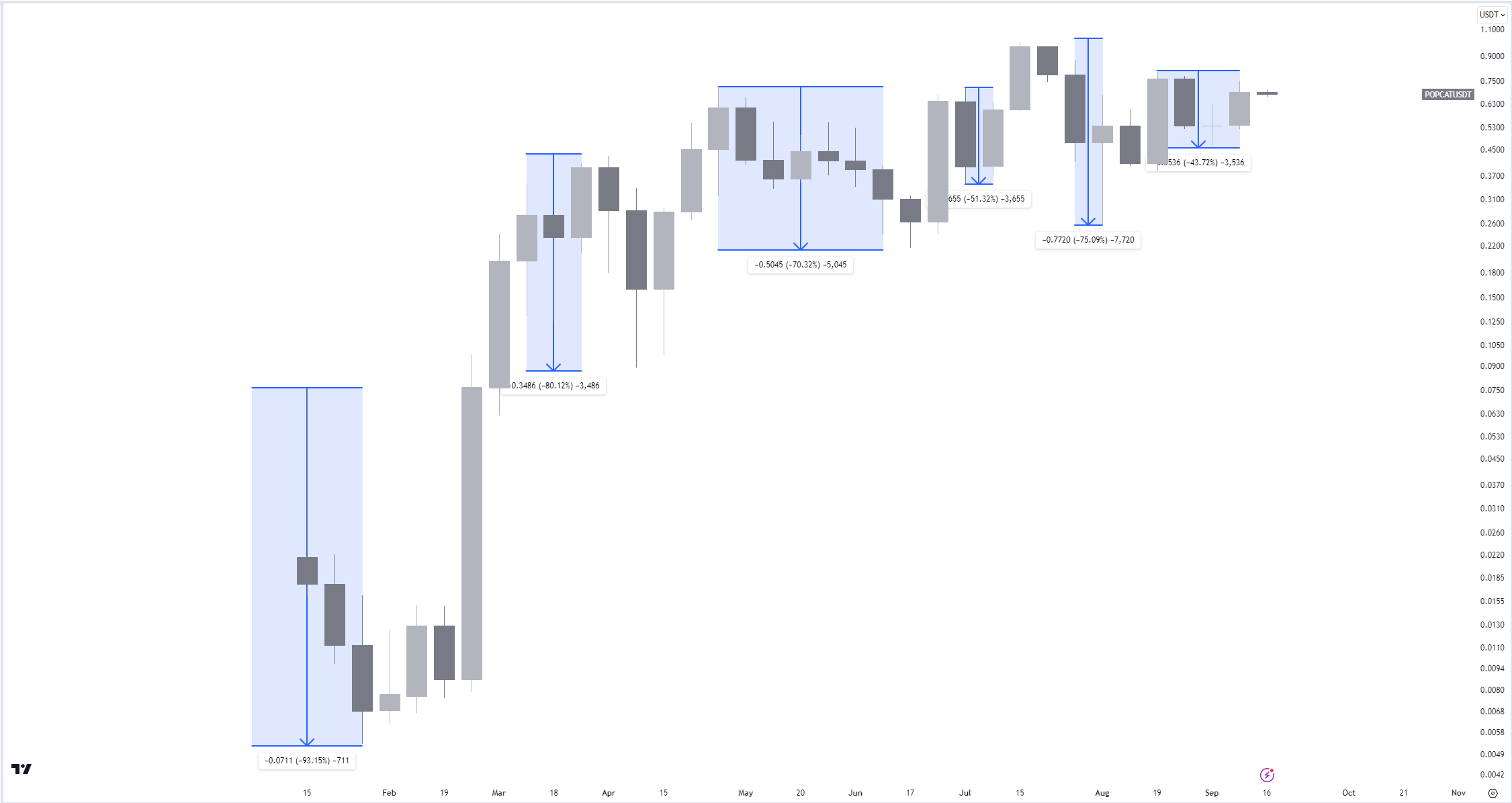

stuff like wif popcat pepe are exceptions.

even in those exceptions you have routine 70%-90% corrections.

so this is not something everyone can trade the same way let alone handle such vol in the same manner.

if you are going to trade them it then its important to have your own thinking on how you would trade them.

thats why you have been given access to an indicator too, to help with trades.

if you are expecting anymore handholding then you are likely to be disappointed. I have made that abundantly clear in all FAQs and so many updates.

all I can continue to do is, keep things consistent in meme selection

All the selected memes have common theme/pattern like universal, memeable, scalable with a organic community behind them.

all of these have trend, momentum, relative strength and price action at its core like all others.

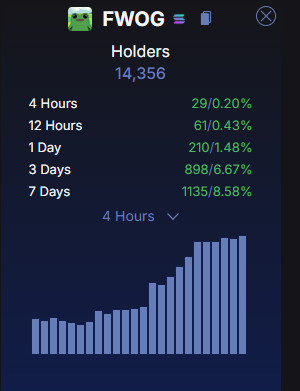

ill cover FWOG in this update (you can apply similar thinking to all other memes/alts too) since its gotten a lot of attention and is all over the twitter timeline.

in terms non-technicals, nothing has changed.

its still got very good artwork, memes and "the pepe of solana narrative" going for it.

infact the whole artwork narrative is strong that there are tons of derivates that have popped up trying to copy it.

the community and holders are also growing.

considering entry sub 10m a 1000% move in 1 month is great by any stretch.

in terms of technicals.

theres a short term trend exhaustion at 100m area.

its also a psychological round number so profit booking is only natural at those levels.

trend exhaustion typically gets resolved in 3 ways

1. theres an immediate upside catalyst (example: some big accounts backing it or it gets listed in some big exchange or any positive news)

2. theres a time correction till the whole churn is complete and its ready for next leg up.

- it goes to major support area where value hunters again build positions.

(1) is always hard to predict as catalyst is only known in hindsight.

(2) and (3) are relatively easier.

incase of FWOG daily closing above 0.09 would signal a strong momentum again and would be an ideal outcome. major support areas lie in 0.03 region.

w3q indicator will automatically pick it up wen the trend & momentum turns. for now its red.

how you choose to play it (short term or long term) would totally depend on your style.

see you in the next one.