Crypto Update: We are back?

Let's call a spade a spade.

The model failed to capture the GOD candle move that happened in Bitcoin last week.

There is no shame in being wrong or admitting when things haven't played out.

While it is annoying that this trade dint work as expected,

But the more important question is, was something wrong in the process?

Don't believe that to be the case. Here's why

In the last week's update, the below was written

The model continues to be bullish on BTC Dominance.

There has been positive news-flow momentum in the Crypto space thanks to the BTC ETF filing by BlackRock.

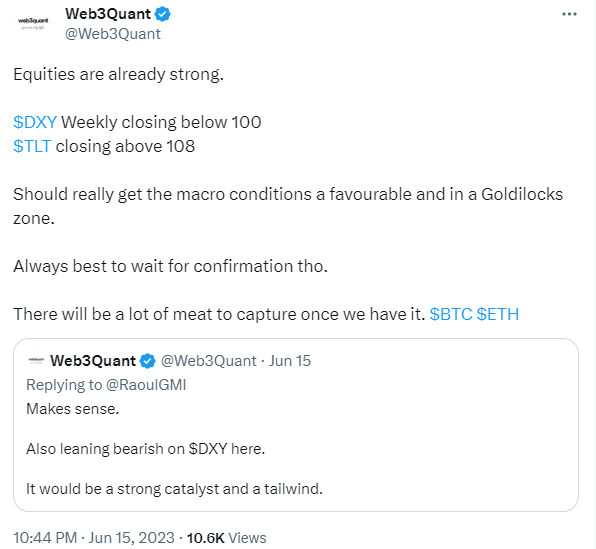

Weak DXY is also a positive development for Risk on an asset like Crypto.

But we need all that news to translate into prices and bullish HTF close to go Long.

We can always go back and argue BlackRock news was obvious. As you can see the News was out when the last update was published. But the markets didn't react to it for many days.

It could have very well gone the other way too. Hindsight is always 20/20.

It's not that Model was bearish on BTC or crypto. In fact, if you see the weekly update or Twitter Updates. It's been all bullish commentary.

Not only that, last week there were 3 longs published.

MTL ANT SFP - In spite of Alts getting hammered and BTC Dom going on a tear. All the 3 alts were up over 20-30% at one point during the week. These are not small moves.

Lastly, while CT is now celebrating the Short squeeze after the ETF news.

The day SEC went after Coinbase and Binance, the entire space was untouchable and many were calling for the demise of Crypto

This update was published Did SEC set themselves up for a short squeeze?

Do take the time to read this update again.

OK, so all of that is just mid-week musing. The big question is where are we headed next?

It appears that BTC is very likely headed to mid 30K region where the next cluster of resistance lie.

Also, strong trends give very shallow pullbacks. It does not give a chance for the shorts nor longs who capitulated to position back into the trade. Something to factor in during this leg.

The model was signaling bullish on LTF which is what was driving all the bullish thesis and commentary but Waiting for HTF confirmation is part of the process. It's something that has worked for us in the past and we will continue to follow it.

This week's price action was indeed an anomaly where BTC went from deeply oversold to a GOD candle in the middle of the week.

Now we cannot design models around anomalies. It's something we need to accept and move on.

Only good discretionary traders and LTF models would have been able to capture such moves.

Coming to Model positions. There have been many long entries.

NOTE: Considering there's been a GOD candle week. Some pullback is to be expected. Do NOT FOMO into positions.

W3Q has just published a How-To guide for those interested in learning how to best use the model insights.

Try and get more optimal entry points. and go light on sizing. Once the trend solidifies further, the moves will be sharper in Alts.

** Web3Quant is not registered with any financial regulatory agencies. Web3Quant is purely a research publishing firm that provides no personalized financial advice. Do your own research and consult your financial advisor.**