Crypto & NFT update

Let's do the crypto update first, then we can get to the NFTs.

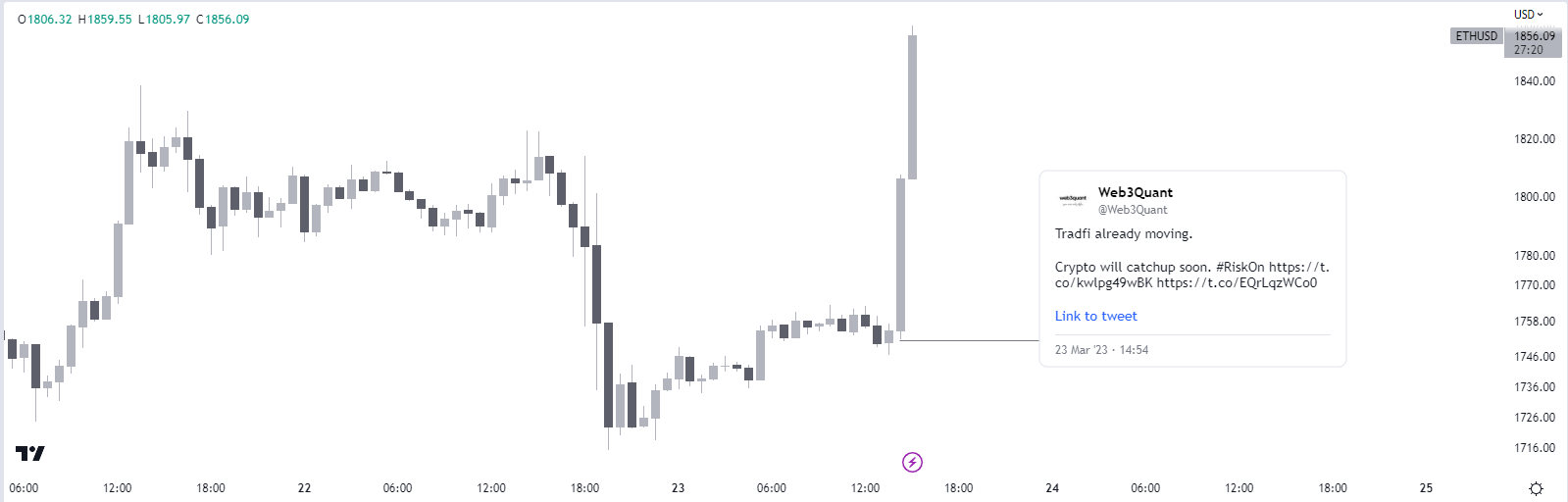

As mentioned in the last update FED policy has reversed in terms of providing liquidity and all indicators are pointing towards a rally in Risk on assets.

Earlier today also tweeted about a potential bullish reversal.

Purely from a sentiment standpoint, there's a bit of complacency creeping into the markets after the FEDs liquidity injection.

Models picking up signs of exhaustion in lower time frames.

Also there's a sharp enforcement action from the SEC and due to banking fears, the liquidity in Crypto is low. Any adverse newsflow could cause sharp reactions.

Now, this doesn't mean an outright SELL signal yet.

It means when things are heated up on lower time frames, it's best to play defense.

There are 2 ways by which the market flushes out excesses. Price correction and Time correction.

The latter would be ideal but just sizing of the trades should be done keeping in mind the possibility of the former too.

Hedging your trades might not be such a bad idea.

Models picking up bullish signals on VIX. If it plays out then it could lead to a sharp pullback.

There's divergence in TradFi stocks too. While $NDX showing resilience, $SPX has been weak. Something needs to give here too and one would need to catch up with the other.

Will wait for the weekly close to determine the way forward but keep an eye out for nasty shakeouts and reversals.

Also, if it's just a time correction then, we could get back on the offense again. Till then keep an open mind and be nimble in positioning.

Coming to Models positions.

Among the recent long picks from the update couple of days ago, $JOE and $TOMO are showing good strength and are up 12% and 20%.

Lastly, $BTC has an extremely strong narrative and flows in its favor.

Regardless of the LTF shakeouts, I would personally be just holding $BTC.

In these extraordinary times, if there's one asset that doesn't feel risky to hold, it would be BTC in my view.

Coming to NFT Positions mentioned in the last update

None of the invalidations have been hit which is good news.

Also, some of the Models NFT longs have done well. Since the longs were published

Punks are up over 20%

ODBS are up over 25%

There have been no exits, and 2 new entries.

MAYC and BAYC

NOTE: If you are an NFT trader, do get in touch, Twitter DMs are open. Would like to get feedback on, how these NFT ETFs insights would help with trading actual NFT collections.

** Web3Quant is not registered with any financial regulatory agencies. Web3Quant is purely a research publishing firm and does not provide any personalized financial advice. Do your own research and consult your financial advisor.**