charts.. potential breakout

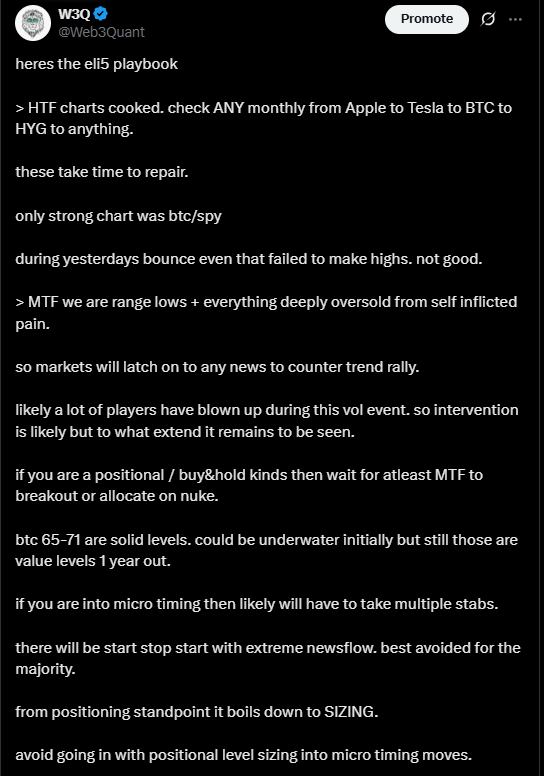

for a while I have been focused on it being a traders market.

we have scalper/swing system (results at the end) that has been performing well but today we will focus on the positional system.

high time frames is where big moves are made and more relevant to sizing and holding for medium to long term.

way too much is happening from a news flow standpoint.

it seems like world is crumbling around like covid times (different reasons but similar backdrop from a financial markets standpoint).

everyone has a thesis how this will pan out and will argue till their face turns blue.

things have gone from being analytical to being emotionally driven.

as always its more important to see what the tape is telling us.

you would be surprise how you can switch off all news or twitter

just watch the charts once a week, have some simple system and outperform the majority.

lets do the macros first, then crypto and then stocks.

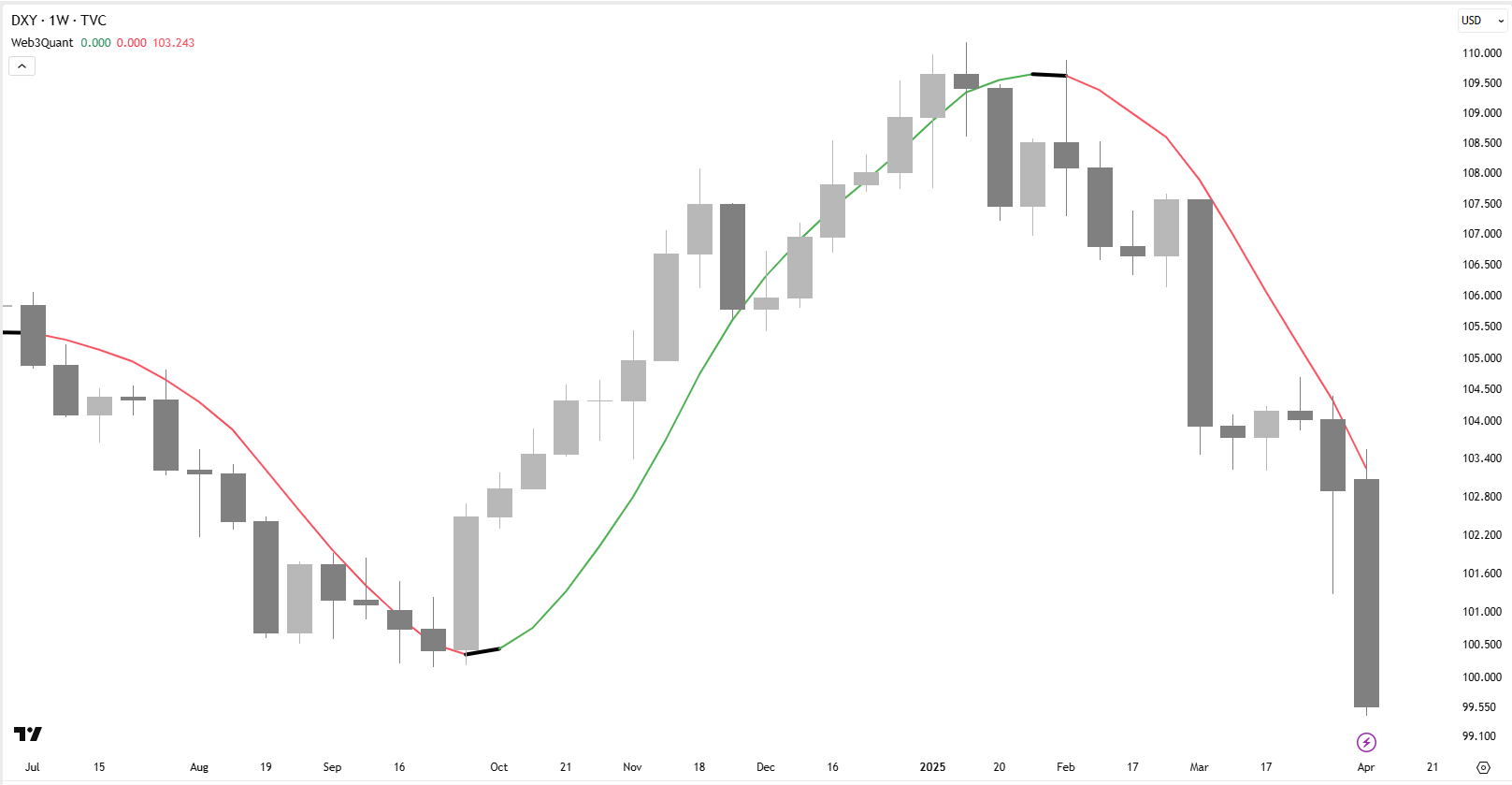

everyones losing their minds with the dollar move and rightly so.

its not everyday reserve currency of the world falls 10% in straight line but the system perfectly caught the swing both sides.

GOLD never got the memo. doesnt know what the fuss is all about.

This is how it did BTC last cycle.

>got you in at the cycle lows.

>kept you out 2024 summer chop.

>got you in September 2024 breakout

>got you out in Jan 2025 at over 100K.

>kept you out of 2025 crypto painful drawdown.

for a passive weekly directional bias.. its phenomenal.

and its not that we havent had 'newsflow' this cycle.

from BTC etf approval (fake and real.. iykyk) to it being a reserve asset to sovereign funds and countries buying it.

BTC has had it all. everyday since last 2 years has been some 'event' or the other.

despite that it paid of to keep things simple.

currently its threatening a breakout on weekly. something to pay attention to when it does.

showing XRP, DOGE & PEPE here as they have the highest volumes but price action for most memes & alts have been similar.

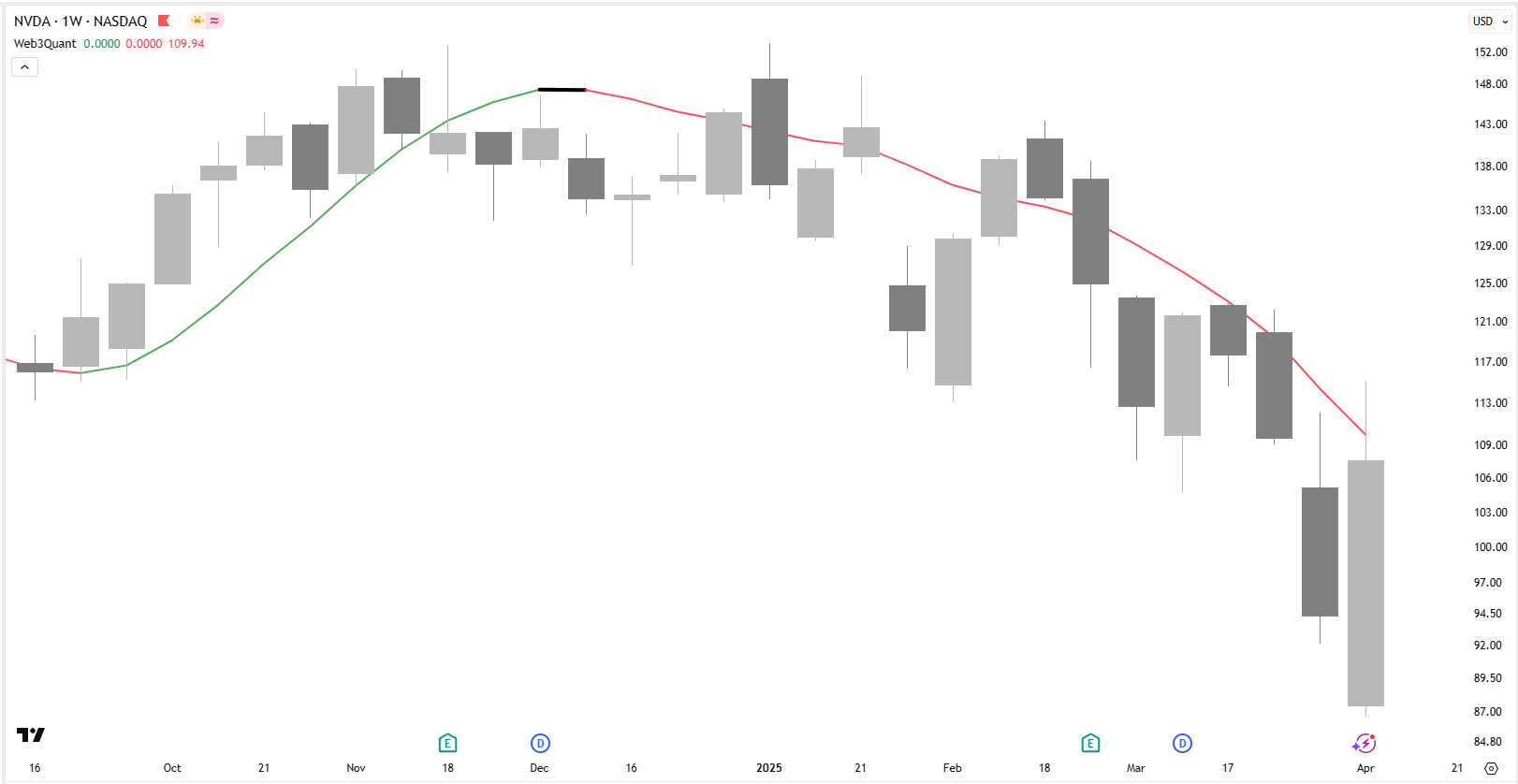

coming to stocks. while you have 1000s

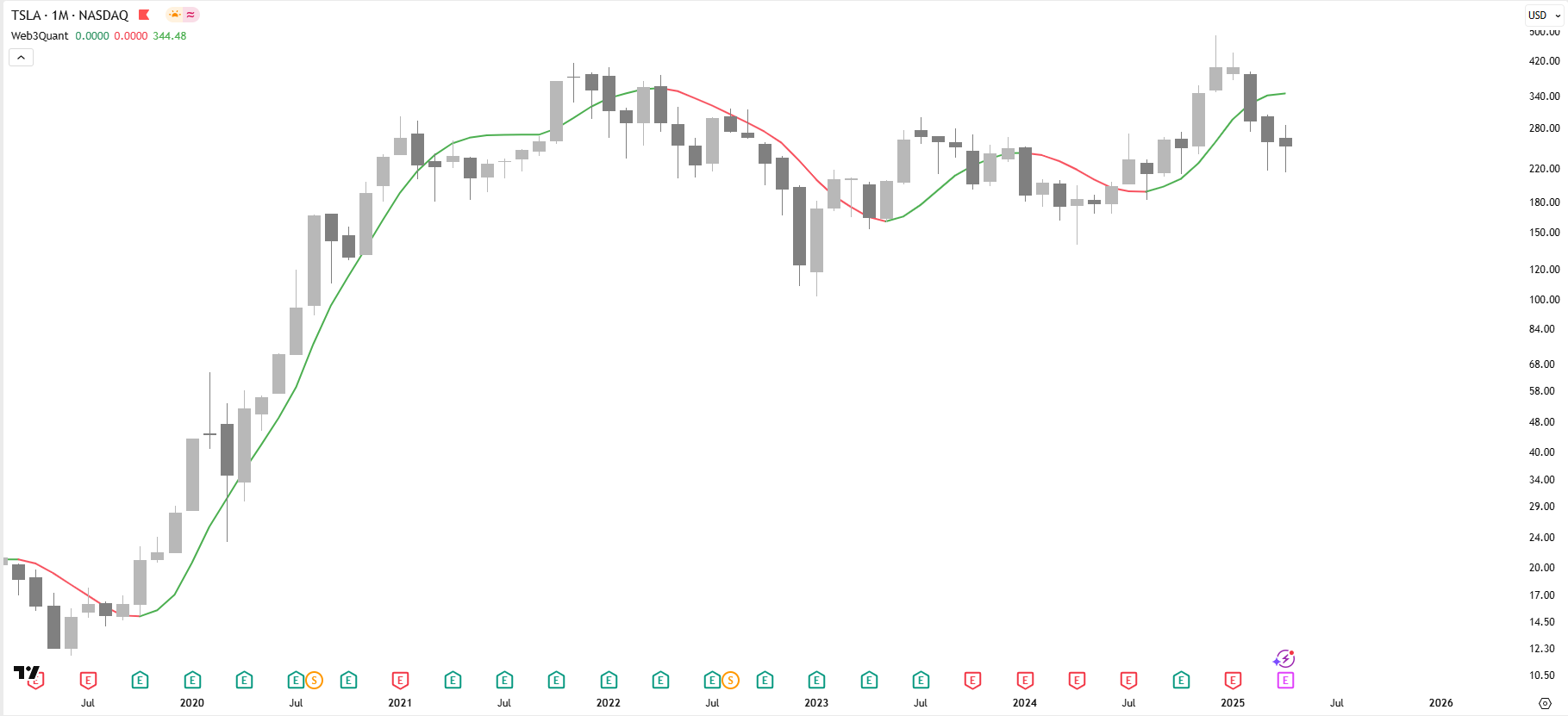

if you just did Tesla and Nvidia. you can pretty much get a grasp on the entire markets pulse.

from tariffs to global scale to AI to semiconductor to innovation to highest retail and options interest and traded (institutions) these 2 stocks have it all.

same system worked pretty well there too.

now all of this great theres one area that needs serious consideration.

I tweeted about it.

if you spend time on Twitter. you are perpetually in a state of FOMO.

every green and red candle is hyped up.

we are sooo back to its overrrrrr. its exhausting.

I think most of our dopamine receptors are fried to a point we cannot tell what is a big deal vs whats not.

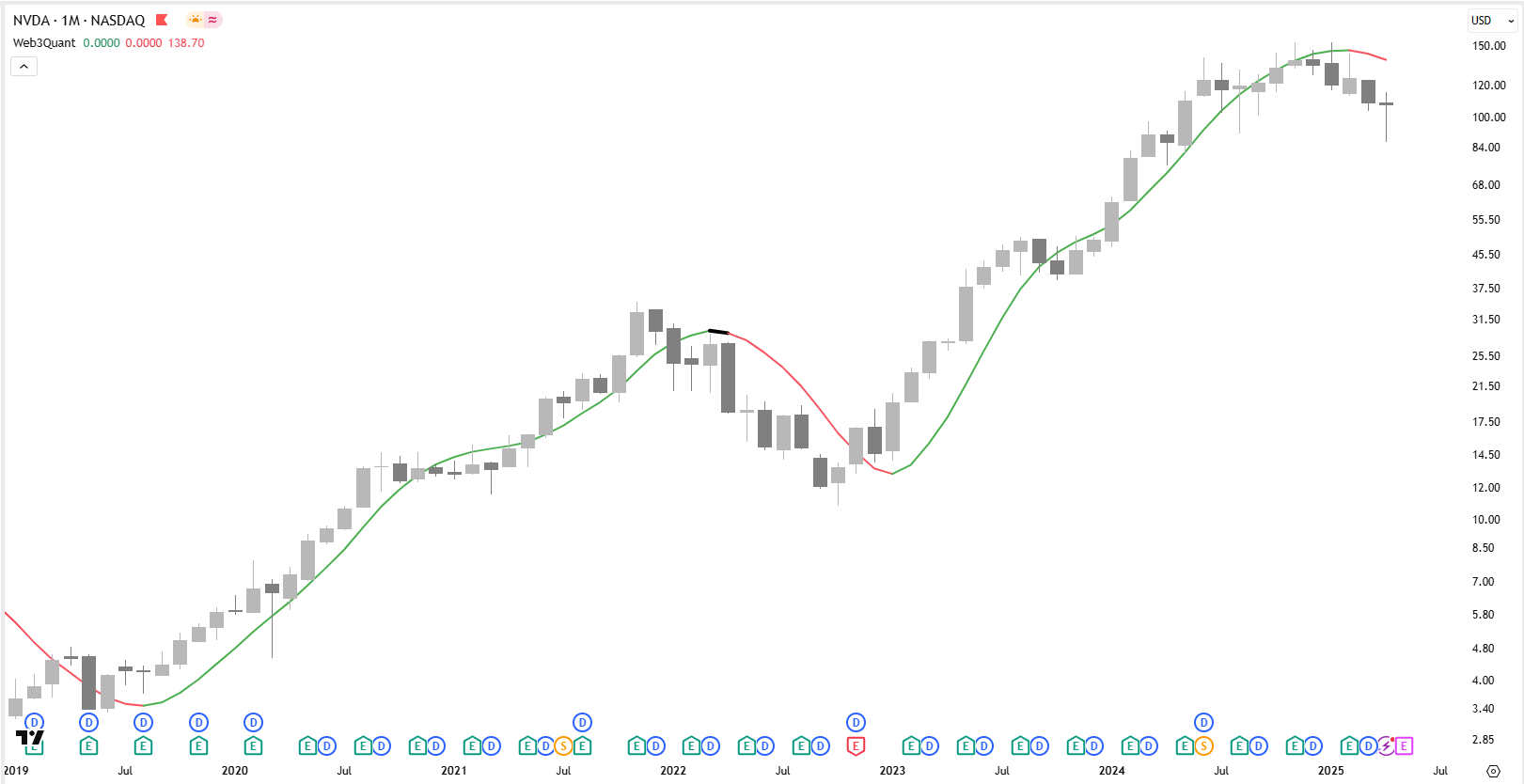

You cannot trade using monthly charts.

reason being by the time they signal its too late. but

it helps you in sizing and assessing how deep we are in a trend timewise.

now we will relook at the same charts on monthly

i will explain the first. rest you will get the idea

this chart btc since inception. barring the COVID shock (marked). its been pretty spot on.

currently we have the same footprint as we had in 2014/2018/2022 already.

'already' part has the entire crypto community perplexed majority expected a bear in 2026.

silver lining is its not turned red yet so we could very well have big breakout on weekly due to

covid like shock induced by Trump policies forcing intervention by govt globally.

climax by the end of the year and 2026 could be like other bear years. its always easier to react than to predict these.

but why is it not my base case? you will see in charts

>macro (HYG)

>BTC/GOLD chart.

>and alts.

for those who dont know HYG is the most important macro chart from a signaling perspective.

its gauges economic health much cleaner and also common sense than anything else.

for the uninitiated a very simple explanation on why HYG?

HYG is a High Yield Corporate Bond ETF aka JUNK bonds.

bonds issued by companies with lower credit ratings, which makes them riskier.

When HYG prices go up, it means investors are willing to buy these riskier bonds, suggesting they believe the economy is strong and companies are less likely to default and vice versa.

picture is worth a 1000 words.

look at the chart below.

system flashed red on july 2011, june 2013, aug 2014, Nov 2017, Feb2020, Nov 2021 and now.

every crypto bro know these dates by heart and what happened next.

july 11, june 13 & aug 14 is a bit spooky coz back then BTC was a fringe asset not even a macro correlated yet it had big drawdowns then too.

secondly charting btc against gold gives you an idea of its relative strength..

after all its digital gold .. but we get a smoother price curve too.

as you can see its not just turned red once but again this cycle.

all this when BTC (crypto) has been on the forefront of all news US president talking about it. appointing crypto czars. Having BTC strategic reserve etc.

BTC has had every good news possible yet price failed to make a new high.

NOTE: on the flip side. what we are seeing currently with Trump Tarif saga, this is exactly what BTC was built for.

We always have this 'nothing ever happens' during a scare but if something were to happen then BTC is a flight to safety.

This is why I have been of the view you either buy the weekly breakout or a nuke.

so you are not left behind in case 'something happens' nor holding bags if its another bear year.

while BTC has some narrative to get flows.

Theres hardly any for alts.

last cycle atleast there was a veil of 'building'.

This cycle it became evident pretty early that barring BTC and Stablecoins most of crypto use case is speculation or speculation supporting infra.

hence you saw memes flying from the beginning not at the end.

I am not judging. I love trading and crypto has the best opportunities. and I will trade anything that moves.

We just need to know what games we are playing is all. and never drink too much koolaid.

new season will bring new alts. as always. this phenomenon is not new to crypto. even stock cycle is the same. every bull run has new darlings. and old ones seldom repeat.

Heres stocks. some think stocks are different to crypto. not really. they all follow the same risk on curve. some lead some lag is all.

they too are telling the same story.

the only deviation I see playing out is when theres legit threat to the current fiat system or US goes extreme and applies capital controls etc.

Then we are likely to see crypto take off in a big way deviating.

people have been calling for it for a while now. some since BTCs inception.

these are macro shifts. once in life time event. can happen tomorrow or a in a decade.

being early is as good as being wrong.

you dont get to 'called it' if it plays out in 2030 and in the interim you had to face gut churning drawdown.

now regardless if its a bear or bull theres always plenty of trading opportunity.

will show you results from the scalper. you can see the entry/exits on shorter timeframes.

S&P500 is supposed to be the most efficient market on the planet.

system signaled exit well BEFORE the TARIFF news hit.

even TSLA exit signal came in near the top over 400 before the 50% drawdown.

see you in the next one.